New Hampshire Seller Closing Cost Calculator

Get a better idea of how much your home sale will cost using HomeLight's Closing Cost Calculator for New Hampshire sellers.

Understanding Closing Costs When Selling Your Home in New Hampshire

Selling your home in New Hampshire involves more than just putting up a "For Sale" sign and waiting for offers. Among the key financial considerations you'll need to navigate are the closing costs. These are the fees and expenses that sellers incur when completing a property transaction. Utilizing tools like HomeLight's Closing Cost Calculator can provide a clear estimate and help you plan your finances effectively.

What Are Closing Costs?

Closing costs refer to the various fees, taxes, and expenses sellers must cover to finalize a home sale. These can vary depending on your property's location, the terms of your sales agreement, and local regulations. Typically, closing costs include real estate agent commissions, property transfer taxes, title fees, attorney fees, and additional charges such as prorated property taxes and utility bills.

How HomeLight’s Closing Cost Calculator Helps

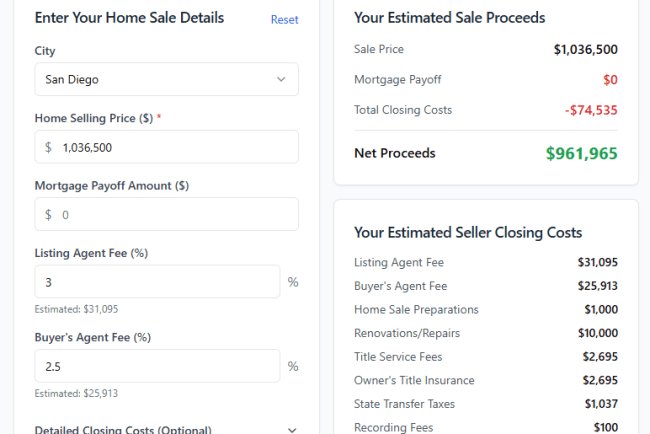

HomeLight’s Closing Cost Calculator specifically tailored for New Hampshire sellers is a valuable resource. It provides accurate, localized estimates based on current market rates, allowing you to see a detailed breakdown of anticipated expenses. With this tool, you can enter your property’s sale price, outstanding mortgage balance, and additional specifics to receive a comprehensive summary of expected costs.

Common Closing Costs for New Hampshire Home Sellers

Real Estate Agent Commissions

One of the largest expenses for sellers is typically the real estate agent commission. Usually, this fee ranges between 5% and 6% of your home's final sale price, split between the seller’s and buyer’s agents. Negotiating a favorable commission rate can significantly impact your total closing costs.

Transfer Taxes

In New Hampshire, the real estate transfer tax is another considerable expense, amounting to approximately 1.5% of the home’s sale price. Generally, this cost is evenly divided between the buyer and the seller, each paying roughly 0.75%.

Title Insurance and Fees

Ensuring clear ownership of the property requires title services, which include title searches and title insurance. While buyers typically cover the owner's title insurance, sellers might pay for certain related fees or additional title searches if required by the sales agreement.

Attorney Fees

New Hampshire law mandates the involvement of an attorney in real estate transactions. Attorney fees vary but generally range from $500 to $1,500, depending on the complexity of the sale and the attorney’s hourly rates.

Outstanding Mortgage and Liens

Any existing mortgage balances or liens against your property must be fully satisfied at closing. The outstanding loan amount, along with any applicable prepayment penalties or administrative fees, will be deducted directly from your sale proceeds.

Miscellaneous Costs

Prorated Property Taxes and Utilities

Property taxes and utilities are often prorated, meaning you pay for your portion of these expenses up to the closing date. Accurate calculation ensures fairness and prevents disputes between buyer and seller.

Home Repairs and Inspection Fees

Negotiations following home inspections can lead to additional repair costs borne by the seller. Anticipating potential issues and addressing them early can mitigate unexpected expenses during the closing process.

Strategies to Minimize Closing Costs

Negotiate Agent Commissions

Given the significant percentage real estate commissions represent, negotiating a lower commission can lead to considerable savings. HomeLight connects you with highly-rated agents who are often open to competitive commission structures.

Schedule a Pre-Inspection

Conducting a pre-inspection helps identify potential issues early, allowing you to manage repairs on your own timeline and possibly reduce costs associated with buyer negotiations.

Consider Timing Your Sale

Timing can influence your expenses. Selling during peak market seasons may not only yield a higher selling price but also improve negotiation leverage concerning closing costs.

Leveraging HomeLight’s Tools for a Smooth Transaction

HomeLight offers various resources, including the Closing Cost Calculator, designed to streamline the selling process. By accurately estimating closing costs early, you can budget effectively and approach negotiations with confidence.

Conclusion

Selling a home in New Hampshire requires careful planning around closing costs. Leveraging tools like HomeLight’s Closing Cost Calculator equips you with precise financial forecasts, ensuring you're prepared for every expense associated with your property sale. By understanding these costs clearly, you’ll be positioned to complete your home sale smoothly and successfully.