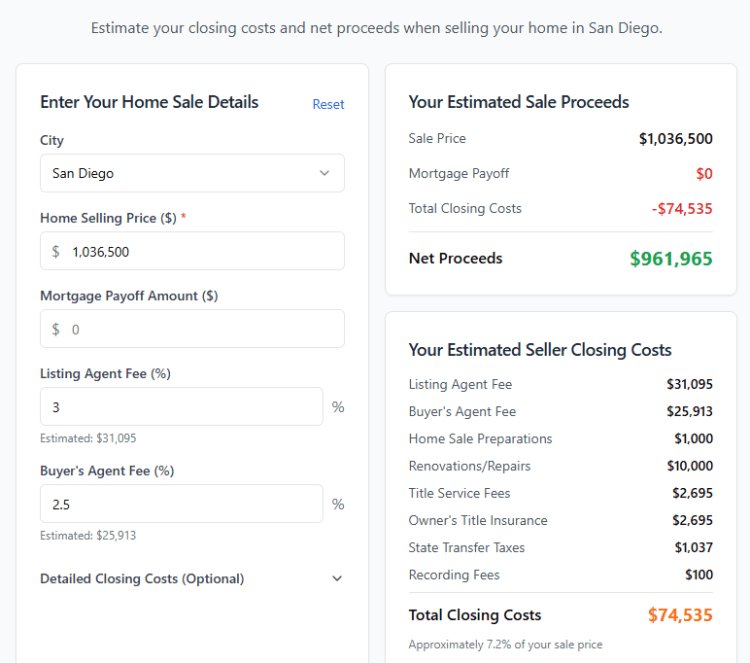

San Diego Seller Closing Cost Calculator

Get a better idea of how much your home sale will cost using HomeLight's Closing Cost Calculator for San Diego sellers.

Understanding Your Home Sale Costs in San Diego: A Comprehensive Guide

Selling your home in San Diego is an exciting yet intricate process. While sellers often focus on the potential profits, it's equally important to anticipate and understand the costs associated with the sale. HomeLight’s Closing Cost Calculator provides a valuable tool for estimating these expenses, giving sellers clarity and control over their financial expectations.

What are Closing Costs?

Closing costs encompass various fees and expenses paid during the finalization of a home sale. Typically, these costs can range between 6% to 10% of the home's sale price. They include agent commissions, escrow fees, title insurance, transfer taxes, and various other expenses related to finalizing the sale.

Real Estate Agent Commissions

One of the most significant costs you'll face is the real estate agent's commission. In San Diego, commissions typically amount to around 5% to 6% of the home's final sale price. This fee is usually split between the buyer's agent and your listing agent. For instance, on a $800,000 home, the commission could range between $40,000 to $48,000.

Escrow and Title Fees

Escrow fees cover the services of an escrow company that handles the transfer of funds and paperwork between the buyer and seller. Title fees ensure the home’s title is clean, meaning there are no disputes or claims against the property. In San Diego, escrow and title fees typically add up to around 1% to 2% of your home's sale price.

Transfer Taxes

San Diego has specific regulations regarding transfer taxes. Generally, the county charges approximately $1.10 per $1,000 of the sale price. For example, a $800,000 property would incur about $880 in transfer taxes. These taxes are typically paid by the seller but may vary depending on the sale agreement.

Inspection and Repairs

Although optional, inspections and necessary repairs can become significant costs during the sale process. Buyers commonly request home inspections, and sellers may need to address issues such as roofing, plumbing, electrical systems, or structural concerns. Budgeting around 1% to 2% of your home's value for potential repairs is prudent.

Home Warranty Costs

Some sellers offer buyers a home warranty as an incentive or reassurance. This warranty typically covers major systems and appliances for one year after the sale, costing the seller approximately $500 to $700.

Staging and Marketing Costs

To attract buyers and potentially increase your home's sale price, investing in staging and marketing services is highly beneficial. Professional staging can cost between $1,000 and $5,000, depending on the property's size and condition. Additionally, marketing efforts, such as professional photography and listings, typically range from $500 to $2,000.

Mortgage Payoff

If you have an existing mortgage, a significant portion of your proceeds will go towards paying off the remaining loan balance. Ensure you account for any prepayment penalties or administrative fees associated with this payoff.

Miscellaneous Fees

Other smaller fees might include recording fees, HOA transfer fees (if applicable), and attorney fees. While individually small, these can collectively add several hundred to a couple of thousand dollars to your total expenses.

How HomeLight’s Calculator Helps

HomeLight's Closing Cost Calculator simplifies the estimation process, providing an accurate breakdown tailored specifically to San Diego sellers. By inputting details such as your home's sale price, outstanding mortgage balance, and expected costs, the calculator offers a transparent overview, enabling effective financial planning.

Planning for Success

Understanding your home sale costs beforehand can significantly alleviate stress during the transaction process. Utilize resources like HomeLight’s Closing Cost Calculator to ensure transparency and readiness. Preparing adequately for these expenses can help you set realistic expectations and facilitate a smoother, more profitable home-selling experience in San Diego.