Long Island Seller Closing Cost Calculator

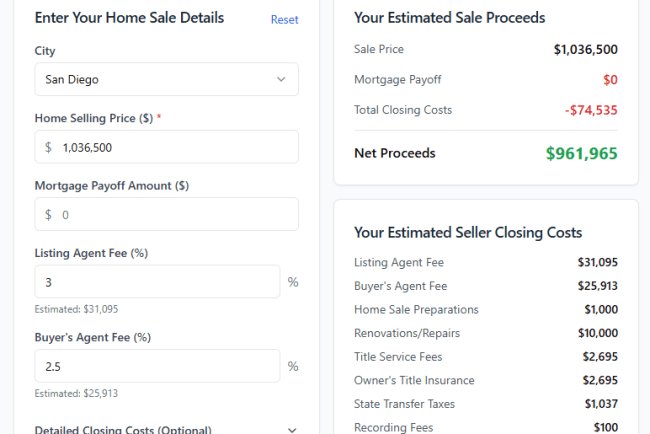

Get a better idea of how much your home sale will cost using HomeLight's Closing Cost Calculator for Long Island sellers.

Understanding Your Home Sale Costs: A Guide for Long Island Sellers

Selling your home on Long Island is an exciting but financially intricate process. To accurately anticipate how much money you'll actually walk away with, it's essential to factor in closing costs. HomeLight's Closing Cost Calculator can offer you precise insights. This guide breaks down the common closing costs Long Island sellers face, helping you navigate the sale process smoothly and avoid surprises.

What Are Closing Costs?

Closing costs refer to the various fees and expenses you'll pay at the close of your property sale. Typically, these costs range between 8% and 10% of the home's sale price. Accurate budgeting ensures you're prepared and can strategically price your home to meet your financial objectives.

Major Components of Closing Costs

1. Real Estate Agent Commissions

The largest portion of closing costs typically consists of real estate agent commissions. On Long Island, these commissions usually range from 5% to 6% of your home's sale price. This fee covers both your listing agent and the buyer's agent. Negotiating commission rates ahead of listing can significantly affect your net proceeds.

2. Transfer Taxes

New York State imposes a transfer tax on home sales, typically calculated at 0.4% of the sale price. Additionally, sellers in Long Island's Nassau and Suffolk counties may be subject to local transfer taxes, which vary slightly by locality. Factor these taxes into your sale calculations early in the process.

3. Attorney Fees

In New York, attorneys are commonly involved in real estate transactions. Expect attorney fees to range from $1,500 to $3,000. These fees cover contract reviews, negotiation, document preparation, and representation during the closing.

4. Title Insurance

Title insurance protects both the buyer and lender from potential title defects. Typically, sellers pay for the owner's title insurance, averaging around 0.4% to 0.5% of the home's sale price. Clear title insurance ensures a smooth transfer of property ownership.

5. Home Inspection and Repair Costs

Buyers usually perform a home inspection to identify issues that might affect their purchase decision. Sellers may need to cover repair costs or offer concessions. Although inspection costs are generally the buyer's responsibility, repairs can significantly impact a seller's final profit.

Additional Costs to Consider

Home Staging and Preparation

Preparing your home for sale might involve staging, minor repairs, landscaping, and professional photography. Budget approximately 1% to 2% of your home's value to enhance appeal, potentially increasing your sale price.

Outstanding Mortgage Balances and Liens

If you have an existing mortgage or other liens on your property, these debts must be settled upon closing. Request a payoff statement early in your selling process to understand your obligations clearly.

Miscellaneous Fees

Other miscellaneous closing costs include prorated property taxes, HOA fees, recording fees, and possibly utility adjustments. These small yet essential expenses can collectively impact your net proceeds.

How HomeLight's Closing Cost Calculator Helps

HomeLight's Closing Cost Calculator is designed specifically to provide accurate, location-based closing cost estimates for Long Island sellers. Simply enter your property's details, and you'll receive an itemized breakdown of anticipated costs. This clarity enables informed pricing decisions and strategic negotiations.

Strategies to Reduce Closing Costs

Negotiate Commission Rates

Openly discuss commission structures with your real estate agent before signing an agreement. Experienced agents may be flexible, especially if the market favors sellers.

Consider Competitive Bidding

If market conditions allow, multiple offers can provide leverage for better sales terms, including fewer concessions or waived inspection contingencies.

Evaluate Repairs Strategically

Prioritize essential repairs and improvements that yield the highest return. Avoid overspending on unnecessary cosmetic upgrades.

Final Thoughts

Understanding and accurately anticipating your closing costs is crucial for a successful home sale on Long Island. Leveraging tools like HomeLight’s Closing Cost Calculator can demystify expenses, allowing you to enter the market confidently and ultimately maximize your financial return.

By carefully planning and preparing for these expenses, you’ll ensure a smoother, more predictable selling process, ultimately achieving your desired financial outcomes.